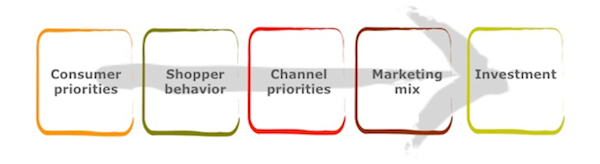

I recently posted a blog about delivering a keynote presentation at the 2013 Shopper Marketing Conference in Dublin. I’d like to share with you the video of my presentation, where I spoke about why marketing is going through revolutionary changes and how shopper marketing has caused this. I’ve also introduced the Five-Step Total Marketing process – practical steps marketers can take to incorporate shopper thinking into their way of working.

Enjoy!

Mike Anthony

Mike Anthony

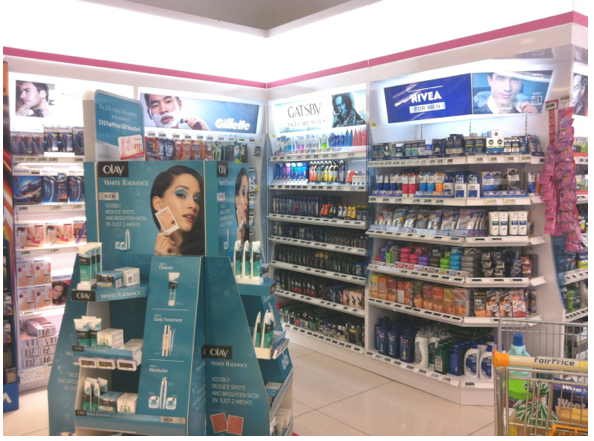

If we accept that moms might be a key group to target, we also have to accept that in order to reach them, we have focus on the retail channels they shop in. I’m guessing that most people buying shampoo for their kids do so when they are buying groceries for the whole house, so I was keen to see what Unilver was doing in Singapore’s leading chain of supermarkets, Fair Price. And here’s what I saw: the brand is neatly positioned with other anti-dandruff shampoos:

If we accept that moms might be a key group to target, we also have to accept that in order to reach them, we have focus on the retail channels they shop in. I’m guessing that most people buying shampoo for their kids do so when they are buying groceries for the whole house, so I was keen to see what Unilver was doing in Singapore’s leading chain of supermarkets, Fair Price. And here’s what I saw: the brand is neatly positioned with other anti-dandruff shampoos:

Last week I was both lucky and excited to travel to Dublin to Keynote at the 2013 Shopper Marketing Conference, hosted by Ireland’s leaders in in-store marketing, Visualise. I say I was lucky, because until the week before my partner Mike Anthony was slated to speak but emergency surgery kept him from travelling.

Last week I was both lucky and excited to travel to Dublin to Keynote at the 2013 Shopper Marketing Conference, hosted by Ireland’s leaders in in-store marketing, Visualise. I say I was lucky, because until the week before my partner Mike Anthony was slated to speak but emergency surgery kept him from travelling. Ok – I admit it – I’m a category management skeptic. I wasn’t always that way, back in the early nineties I was a massive supporter – working with major retailers using a clear process which supported collaboration made loads of sense. At a time when traditional advertising was becoming less effective and marketing at the point of purchase was just beginning, I honestly thought ‘catman’ was the perfect solution.

Ok – I admit it – I’m a category management skeptic. I wasn’t always that way, back in the early nineties I was a massive supporter – working with major retailers using a clear process which supported collaboration made loads of sense. At a time when traditional advertising was becoming less effective and marketing at the point of purchase was just beginning, I honestly thought ‘catman’ was the perfect solution.