For retail watchers around the world, 2013 was a momentous year. So much happened! In the US, dollar stores boomed whilst in the UK discounters grabbed share. In other parts of the world shoppers sought stores closer to home, driving sales in convenience stores, minimarts and local supermarkets. Retail giants, like Carrefour and Tesco felt the pinch: Shoppers turned away from hypermarkets, calling into question the fundamentals of their expansion strategies. And of course shoppers moved online in ever greater numbers. With so much change in the retail landscape, channel priorities must also shift.

For retail watchers around the world, 2013 was a momentous year. So much happened! In the US, dollar stores boomed whilst in the UK discounters grabbed share. In other parts of the world shoppers sought stores closer to home, driving sales in convenience stores, minimarts and local supermarkets. Retail giants, like Carrefour and Tesco felt the pinch: Shoppers turned away from hypermarkets, calling into question the fundamentals of their expansion strategies. And of course shoppers moved online in ever greater numbers. With so much change in the retail landscape, channel priorities must also shift.

Are you still thinking about the modern trade and the general trade?

If so it’s time for a change. You could be missing major growth opportunities in segments of the trade that aren’t even on your radar. At the same time you could be pouring resources into retail behemoths that might be set for long-term decline.

How do you ensure you are getting the best out of the opportunities in your market?

Prioritize channels where you can make change happen

Defining channel priorities is all about understanding the shopper. As shoppers we behave differently in different retail environments. Generically in supermarkets we’re on a mission: to fill our carts as quickly as possible with goods that meet our needs for the next week or two, at least cost. In this environment shopper engagement is often low so your influence on their behavior may be low too.

In other environments, shoppers are much more engaged. Look at how women shop for cosmetics in department stores (generically) or how men get more engaged in electronics stores (again forgive the generalization). Here shoppers are learning about the product as they go and trading off one bundle of features for another. When shoppers are learning about products online, they really do want to know what others think and what the best deal is.

Wouldn’t you rather focus your efforts on getting engaged shoppers to buy?

For every category and every shopper some retail environments have greater potential to influence behavior than others. By focusing on channels where you can influence shopper behavior to drive the sales and ultimately the consumption of your brand, you gain in the long-term. So prioritize channels which not only attract your target shoppers in abundance, but also have the greatest potential for you to influence these key buyers’ behavior.

Work in the channels that want you

Channels are made up of groups of retail outlets – some are easier to work with than others. Take it from your sales teams! Is it really easy to get a deal from mega-retailers? Is it cheap? Most importantly do they actually implement what they promise?

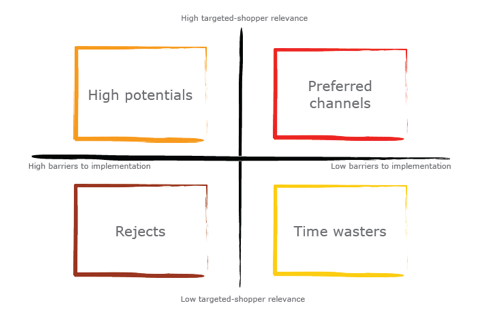

Once you know the channels where you can influence shopper behavior, then focus on those channels in which retailers can and will both embrace and execute activities that have mutual benefit. Seek to focus on those channels which present the lowest barriers to execution. In our book “The Shopper Marketing Revolution”, Mike Anthony and I suggest a simple matrix tool (shown below) that helps you make these decisions.

Dealing with digital

During the course of the coming year, many of you will have to broach the thorny subject of how to deal with digital channels in this mix. For those of you who fall into this group here a few extra tips to consider when you think about channels:

- Prioritize digital in the context of what you already do – View digital as another group of retail environments, not a separate ‘problem’. How you choose to prioritize digital channels will affect the way you manage physical ones in the long-term, so ensure you take a portfolio approach.

- Digital is not one environment – it’s many – In the same way as there is not one type of ‘shop’ you sell your products in, e-commerce is not one homogenous environment. Major manufacturers now segment e-com outlets into a number of separate groups, each with its own specific characteristics and then prioritize these accordingly, within the context of all retail channels.

- Use the same metrics to evaluate digital as you would any other channel – Just like regular retail channels, e-com channels have varying levels of influence on shopper behavior and differing barriers to implementation. Using the same metrics to evaluate these channels as you would physical ones enables you to prioritize channels across the entire portfolio.

Dealing with changing channel priorities

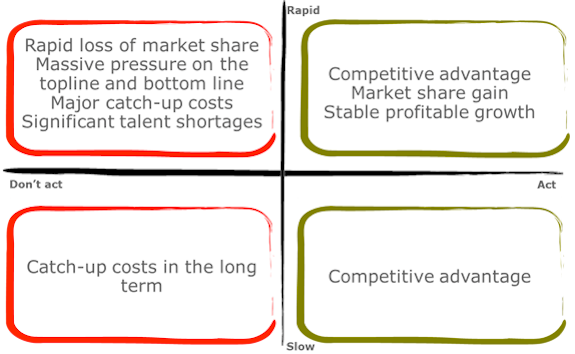

Changing priorities means changing strategies, and these have a wide impact on the organization. The temptation is often to deal with the issues that arise reactively. Instead, a proactive approach to sequentially deal with the strategic changes you will need to make bears fruit:

- In-store strategies – Since the ultimate goal of brands in retail is to encourage more shoppers to buy your brand, more often and in greater quantities, the first thing to establish is the mix of activities that need to go into those outlets in order to be successful.

- Route-to-market strategies – With a clear set of in-store strategies in place you can then re-evaluate your route-to-market to ensure fit.

- Organization strategies – Once you know you can operationally deliver, the next step is to establish how your people will support execution. Define your team structure and competence requirements to deliver you in-store strategies and route-to-market changes.

- Financial strategies – Finally set your investment framework – if the numbers look good – go ahead; if not revise and amend from the beginning!

Re-prioritizing channels is a major undertaking and many managers find the entire idea daunting: fortunately help is at hand. We’ll soon be releasing an eBook on developing channel strategy – sign up here to be the first to get it when it’s published!

A very Happy New Year! As many of us dust of the keyboard and make resolutions regarding our waistlines, thoughts turn to the priorities we might set for the coming year. If you’ve paid attention to the extensive coverage given to online sales over the last month, you may be seriously considering whether this year is the year to make significant investments in online retail channels.

A very Happy New Year! As many of us dust of the keyboard and make resolutions regarding our waistlines, thoughts turn to the priorities we might set for the coming year. If you’ve paid attention to the extensive coverage given to online sales over the last month, you may be seriously considering whether this year is the year to make significant investments in online retail channels.

Last week I wrote about the enormous changes that have taken place in 2013. I wrote about how the use of the internet as a primary source of information is now a global truth; how online shopping is no longer a niche behavior and how the lines between physical retail and online are blurred.

Last week I wrote about the enormous changes that have taken place in 2013. I wrote about how the use of the internet as a primary source of information is now a global truth; how online shopping is no longer a niche behavior and how the lines between physical retail and online are blurred. When the dust settles on the breathless wash-up of retail sales over the holiday season in the US and Europe, we will be left with one major learning: the way people shop has changed. But when we look back at 2013 in years to come, we may well conclude that this year stands as the point in history when the entire process on consumer goods marketing changed forever.

When the dust settles on the breathless wash-up of retail sales over the holiday season in the US and Europe, we will be left with one major learning: the way people shop has changed. But when we look back at 2013 in years to come, we may well conclude that this year stands as the point in history when the entire process on consumer goods marketing changed forever.