It’s been nearly two years since Jim Lecinski at Google published ZMOT – Winning the Zero Moment of Truth. This week I met with friends at Google to talk about their new research into the way shoppers are using the internet here in Asia. Our conversation turned to how much has actually changed since Jim coined the term ZMOT and what that means for the modern marketer.

ZMOT – a new mental model and how it’s changed shopping behavior

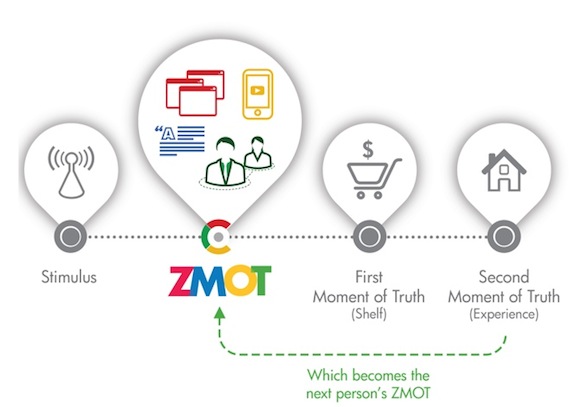

The big insight in ZMOT is that the internet has dramatically changed the way we plan our purchases. In the past shopping happened almost exclusively in stores; today, for even the simplest purchases, many of us spend time learning more about the products we are considering buying, online. This is the new mental model that ZMOT introduced to the marketing community.

As our ability to access larger volumes of information about the products and services we intend to buy has expanded, so has the influence of this information on our purchase behavior.

This creates the opportunity for deeper, more directed and ultimately more effective interactions between brands and their targets. If the way we choose a product has changed, the way we market that product must also change.

Everyone is shopping, online

Whilst not everyone is buying online, when someone is searching for information about a product’s ingredients; seeking a product review or checking out deals and offers, she is actively engaged in the process of shopping. All of these activities help shoppers to interpret what they need to buy more clearly, to establish how their needs as buyers might be best met and to define where they should go to make a purchase. These decisions dramatically shape a family’s consumption behavior.

What this means for marketers is that the internet creates a myriad new ways of influencing purchasing behavior, all of which can support the growth of their brand’s consumption. To make the most of these opportunities though, the way in which most marketers approach digital needs to change.

Help people buy, online

Given all the hype and hyperbole surrounding digital I can’t think of a brand that hasn’t done some work to build a presence online. What’s interesting is how much of this work has simply involved transferring consumer communication online. Don’t get me wrong, I’m not suggesting that consumer communication is unimportant – messages in media that create the desire to use a brand which fuels demand are essential. BUT, if people are using the internet to find information about which product to buy, cool messages that enhance brand awareness can only take them so far.

What people need when they are shopping is information that tells them why they should buy the brand and not just why they should ‘like’ the brand. This is where shopper behavior can be influenced. Many marketers are still leaving too much of this to chance, by failing to manage or respond effectively to product reviews or by allowing information about where best to buy a product to be driven by retailers.

Making the most of ZMOT

I believe there are three things that marketers should be prioritizing as they consider ramping up spending online:

- Learn more – particularly about who is using digital resources to support their purchase decisions, how valuable they are to your brands and what is needed to capitalize this value.

- Target more – develop more granular segmentation models so that you can target more specific niches of the shopping population and encourage purchase behaviors that are more likely to support your brand

- Engage more – expand the focus of your approach to digital beyond education about the brand’s ideals to encompass specific messages that will help target shoppers to buy. This might include more active engagement in peer review environments but equally it might include driving shoppers towards specific retailers and increasingly creating the opportunity to buy immediately.

There’s a huge amount being written in this space currently so if you’d like to know more about this, I’d recommend you download the original ZMOT e-book from Google as a start point but also keep an eye out for the new Asian edition of this which should be available soon. You can also read more on the subject in The Shopper Marketing Revolution which I published with Mike Anthony recently.